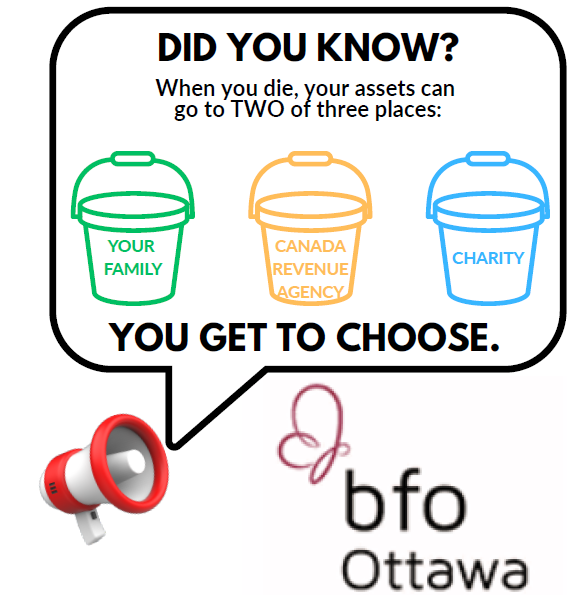

Have you considered leaving a legacy gift to BFO Ottawa?

Choosing to include a chairty like BFO-Ottawa in your estate plan reduces your taxes and leaves a lasting legacy of care.

Here’s a look at seven of the most common types of legacy gifts:

Bequests through wills and estate plans

The most common form of legacy giving is bequests of designated sums of money, assets, or a percentage of an estate left to a non-profit in a donor’s will. These gifts can be given for general purposes or to fund specific areas within the organization.

Charitable remainder trusts

A charitable remainder trust allows a donor to donate assets to a trust, which then provides a trustee with an annual payment. At the end of the trust’s term, the remainder goes to the non-profit beneficiary.

Gifts of life insurance

A gift of life insurance is when a donor names an organization as the beneficiary of an insurance policy or transfers ownership of the policy to the charity

Charitable gift annuities

A charitable gift annuity is a contract where a donor makes a gift to a non-profit in exchange for a fixed sum each year for life. After the donor passes, the remaining balance goes to the organization.

Donor-advised funds

A donor-advised fund is a charitable investment account that a donor can create and use to support causes they care about past their lifetime and specify what the money they’ve donated funds

Endowments

Endowments are invested funds from which a non-profit can use the interest accrued while preserving the principal sum. Donors can give to term endowments that are set up to be invested until the donors passes and then used to fund specific programs or provide general support.

Beneficiaries

Similar to gifts of life insurance, donors can choose to make a non-profit a beneficiary on other accounts, such as their retirement fund.

How did this come about?

BFO Provincial have secured a one-year membership with Will Power as a pilot project. Will Power is a national movement to educate Canadians on the power of making a difference through their Wills. Many people believe they can't support both their loved ones and BFO with their will. The truth is, a small percentage of your estate left to BFO can have a big impact, while still leaving the majority for loved ones. No matter what is offered, you can be a part of this powerful movement for change. We recommend that you seek professional advice from your lawyer, accountant, or financial planner to determine the method of giving that will be the most tax effective for you. Visit our page on Will Power for more information, resources, and to learn about the benefits of making a planned gift to the Bereaved Families of Ontario.